The NAICS Search Tool is a free solution that helps users determine which NAICS Code best represents their industry.

Identify NAICS and SIC Codes and Descriptions, Annual Sales, Employees, Addresses, Phone Numbers, Line of Business and More.

Append NAICS Codes to your Customer Database to easily identify the industries of all your top clients. NAICS Appends are also a powerful resource for Patriot Act & BSA Compliance.

Create a Laser-Targeted Marketing List using NAICS Codes. Additional selectors include Annual Sales, Number of Employees, Geography, Years in Business and dozens more.

NAICS Code List

Click any NAICS Code to Drill Deeper

| Code | Sector Title | Number of US Entities |

|---|---|---|

| 11 | Agriculture, Forestry, Fishing and Hunting | 372,015 |

| 21 | Mining | 33,488 |

| 22 | Utilities | 52,259 |

| 23 | Construction | 1,534,543 |

| 31-33 | Manufacturing | 664,398 |

| 42 | Wholesale Trade | 704,874 |

| 44-45 | Retail Trade | 1,880,608 |

| 48-49 | Transportation and Warehousing | 723,573 |

| 51 | Information | 375,419 |

| 52 | Finance and Insurance | 782,710 |

| 53 | Real Estate Rental and Leasing | 936,111 |

| 54 | Professional, Scientific, and Technical Services | 2,524,263 |

| 55 | Management of Companies and Enterprises | 94,577 |

| 56 | Administrative and Support and Waste… Services | 1,574,695 |

| 61 | Educational Services | 434,159 |

| 62 | Health Care and Social Assistance | 1,707,966 |

| 71 | Arts, Entertainment, and Recreation | 391,011 |

| 72 | Accommodation and Food Services | 928,815 |

| 81 | Other Services (except Public Administration) | 1,967,778 |

| 92 | Public Administration | 256,687 |

| Total US Business Entities | 17,939,949 |

*FREE* 2022 NAICS Reference Files

Historical NAICS Reference Files

2017 NAICS Downloads

2012 NAICS Downloads

Common NAICS Questions

The U.S. Census Bureau assigns and maintains only one NAICS code for each establishment based on its primary activity (generally the activity that generates the most revenue for the establishment). Since other federal government agencies, trade associations, and regulation boards maintain their own lists of business establishments and assign classification codes based on their own programmatic needs, this will vary by agency.

Yes, some agencies assign more than one NAICS codes to one establishment. For instance, the SAM (System for Award Management formerly CCR), where businesses register to become federal contractors, will accept up to 5 or 10 classification codes per establishment. You will need to contact the other agencies to find out what their policies are. For access to a list of federal government agencies, click here.

The U.S. Census Bureau is unable to provide a NAICS or SIC code for a named business over the Internet or telephone without written request.

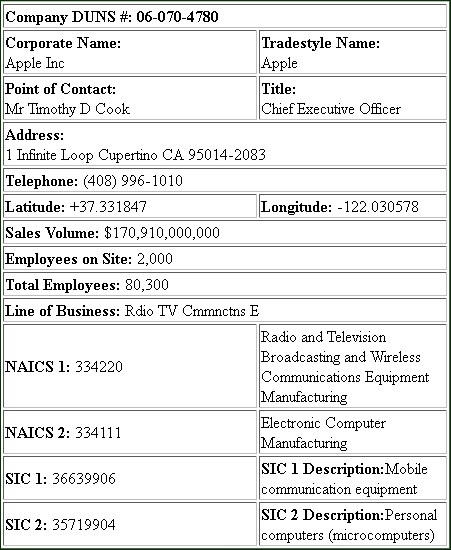

Luckily, we at the NAICS Association can provide statistical information for specific companies with this simple company lookup tool.

Yes. By using the US Company Lookup Tool, you can purchase a company record that includes NAICS and SIC Information, DUNS Numbers, Company Size Information, Addresses, Phone Numbers, Contact Names, Lat/Long and More.

Sample Purchased Record:

Yes! Just Use Either of the Resources Below:

NAICS to SIC Crosswalk

Enter Your NAICS Code to Find the Corresponding SIC Codes

NAICS will be reviewed every five years (in the years ending in ‘2’ or ‘7’) for potential revisions so that the classification system can keep pace with the changing economy.

The Office of Management and Budget (OMB), through its Economic Classification Policy Committee (ECPC), will solicit public comments through a notice published in the Federal Register. The notice will provide details of the format in which comments should be submitted, to whom they should be submitted, and the deadline for submission. Generally, the comment period will close 90 days after publication of the notice.

During that time, suggestions for new and emerging industries can be submitted to the ECPC. This committee will review each comment submitted to determine its feasibility and adherence to the underlying principles of NAICS, consult with the NAICS counterparts in Canada and Mexico to determine if they can accept the proposed changes that would impact 3-country comparability, and then make final recommendations to OMB for additions and changes to the NAICS manual.

This process is now completed for the 2017 revision of NAICS. The next scheduled review of NAICS will be for a potential 2022 revision.

NAICS was designed and documented in such a way to allow business establishments to self-code. There are a number of tools and references available to help you to determine the most appropriate NAICS code for your business:

You can use our Powerful Search Tool to find any NAICS code quickly and easily. Enter a keyword that describes your kind of business. A list of primary business activities containing that keyword and the corresponding NAICS codes will appear. Choose the one that most closely corresponds to your primary business activity, or refine your search to obtain other choices.

Rather than searching through a list of primary business activities you may also browse the NAICS Codes and Titles to find your code. You can select the category that applies to your business, and drill down through the more detailed levels until you find the appropriate 6-digit code.

If you know your old SIC code, you can use our Powerful Search Tool to locate the corresponding NAICS code. Simply enter the SIC code and the corresponding NAICS code(s) will appear.

To see the NAICS code associated with a specific business listing, use our US Business Directory Company Lookup Tool.

For more help with using the NAICS Search tool, click here.

To determine the correct NAICS code for your establishment, first identify the primary business activity. Then refer either to: 1) the NAICS United States Structure to search the titles from the 2-digit level down through the 6-digit, more detailed level, to find the appropriate code; or 2) the Alphabetic Index to search alphabetically for the primary activity and its corresponding code. Next, read the full description of the industry (including the narrative, cross-references, and illustrative examples), and determine if that description fits the primary business activity of your establishment.

You can obtain data for a specific NAICS industry by going to the 2007 Economic Census website. This website provides data at the sector level.

You may also get data by state, or selected metro area by using the pull-down menus in the upper right hand corner of the page. You may also obtain data from the American Fact Finder website.

You can obtain a quick report by either industry or geography by clicking on the links listed. Beginning with the 1998 data year, the annual County Business Patterns reports provide employment, payroll, number of establishments (but not sales/receipts). Click here to view the CBP data.

NAICS is scheduled to be reviewed every 5 years for potential revisions, so that the classification system can keep pace with the changing economy. This is the only time that new NAICS codes can be considered.

The Office of Management and Budget (OMB), through its Economic Classification Policy Committee (ECPC), will solicit public comments regarding changes to NAICS through a notice published in the Federal Register.

The notice will provide details of the format in which comments should be submitted, how and to whom they should be submitted, and the deadline for submission.

Generally, the comment period will close 90 days after publication of the notice. During that time, suggestions for new and emerging industries can be submitted to the ECPC.

This committee will review each comment submitted to determine its feasibility and adherence to the underlying principles of NAICS, consult with the NAICS counterparts in Canada and Mexico to determine if they can accept the proposed changes that would impact 3-country comparability, and then make final recommendations to OMB for additions and changes to the NAICS Manual.

This process is now completed for the 2017 revision to NAICS. The next scheduled review of NAICS will be for a potential 2022 revision. It is expected that the OMB will publish a Federal Register notice soliciting comments for that revision in late 2021 or early 2022.

Every five years NAICS is reviewed for potential revisions, so that the classification system can keep pace with the changing economy. This is the only time that new NAICS codes can be considered. The Office of Management and Budget (OMB), through its Economic Classification Policy Committee (ECPC), will solicit public comments regarding changes to NAICS through a notice published in the Federal Register. The notice will provide details of the format in which comments should be submitted, how and to whom they should be submitted, and the deadline for submission. During the public comment period, suggestions for new and emerging industries can be submitted to the ECPC. The next scheduled review of NAICS will be for a potential 2027 revision. [SOURCE: US NAICS MANUAL]

There is no “official” way to have a company’s SIC or NAICS code changed. Various Federal government agencies maintain their own lists of business establishments, and assign classification codes based on their own programmatic needs.

Generally, the classification codes are derived from information that the business establishment has provided on administrative, survey, or census reports. For this reason, we recommend that you contact the agency that has assigned the code that you believe should be changed.

For example, if you question the SIC or NAICS code contained on a form received from OSHA, you should contact the Department of Labor. For access to a list of Federal government agencies, visit this site.

We have both hard copy and electronic manuals available:

The NAICS Manual is the official hard copy reference containing all the NAICS codes, descriptions, and cross-references. It is the easy “desk-reference” for everything NAICS. You can also find downloadable reference files here.

A business does not ‘apply’ for a NAICS code. As explained above, statistical agencies generally assign NAICS codes based on information provided by a business on an application form, an administrative report, or on a survey or census report form.

[SOURCE: US NAICS MANUAL]NAICS was developed specifically for the collection and publication of statistical data to show the economic status of the United States.

The NAICS categories and definitions were not developed to meet the needs of procurement and/or regulatory applications.

However, other federal agencies trade associations, and regulation boards have adopted NAICS to use for procurement and regulatory purposes even though it does not entirely fit their specific needs.

The U.S. Census Bureau has no formal role as an arbitrator of statistical classification. For questions regarding other agencies’ use of the NAICS system, contact the specific agency. For access to a list of Federal government agencies, visit this site.

Of course, some will have alternate preferences, but we have found the most popular pronunciations for these codes are as follows:

NAICS is said “NAKES” and Rhymes with SNAKES.

SIC is said “Ess-Eye-Sea” or S-I-C.*

*You will notice throughout this site that a single SIC Code will be referred to as ‘AN’ SIC code as opposed to ‘A’ SIC Code for this reason.

There were 1,175 industries in 2007 NAICS United States and in 2012 NAICS United States there are 1,065 industries. For 2012, revisions were made to address changes in the economy. These included content revisions for selected areas, several title changes, and clarification of a few industry definitions. Specifically, the changes include: (1) collapsing detail in the Manufacturing sector to reduce statistical product production costs and respondent burden; (2) adding new and emerging industries; (3) the classification of distribution centers, publishers’ sales offices, and logistics service providers; (4) the classification of units that outsource all transformation activities.

Noticeable changes were made to six of the twenty NAICS sectors during the 2012 revision of NAICS. These sectors are listed below:

-

- Sector 22, Utilities – 2007 NAICS code 221119, Other Electric Power Generation, was deleted and portions of it were reclassified, resulting in the addition of five new 6-digit industries: 221114, Solar Electric Power Generation; 221115, Wind Electric Power Generation; 221116, Geothermal Electric Power Generation; 221117, Biomass Electric Power Generation; 221118, Other Electric Power Generation.

- Sector 23, Construction – Building fireproofing contractors and fireproofing flooring construction contractors were moved to 238310, Drywall and Insulation Contractors.

- Sector 31-33, Manufacturing – Major changes were made in the Manufacturing sector, with the collapsing of detail. Digital camera manufacturing was moved to newly created industry, 333316, Photographic and Photocopying Equipment Manufacturing.

- Sector 42, Wholesale Trade – Electric water heaters was moved to 423720, Plumbing and Heating Equipment and Supplies (Hydronics) Merchant Wholesalers. Gas household appliances (except gas water heaters) was moved to newly titled 423620, Household Appliances, Electric Housewares, and Consumer Electronics Merchant Wholesalers.

- Sector 44-45, Retail Trade – 2007 NAICS codes 441221, Motorcycle, ATV, and Personal Watercraft Dealers, and 441229, All Other Motor Vehicle Dealers, were collapsed into a new 6-digit industry, 441228, Motorcycle, ATV, and All Other Motor Vehicle Dealers. 2007 NAICS codes 454311, Heating Oil Dealers; 454312, Liquefied Petroleum Gas (Bottled Gas) Dealers; 454319, Other Fuel Dealers, were collapsed into a new 6-digit industry, 454310, Fuel Dealers. Subsector 443, Electronics and Appliance Stores, was restructured.

Sector 72, Accommodation and Food Services – Industries in Subsector 722, Food Services and Drinking Places, were restructured, resulting in new Industry Group 7225, Restaurants and Other Eating Places.

DOWNLOAD THE TABLE:

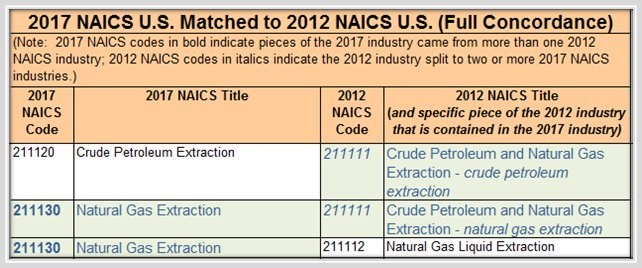

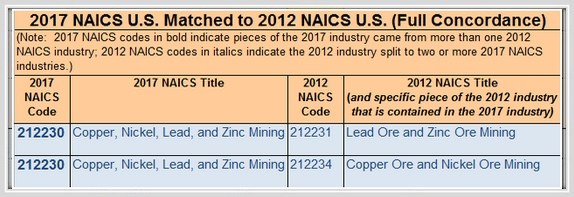

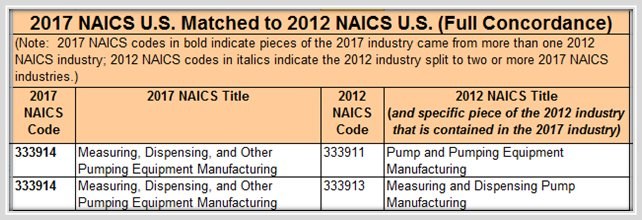

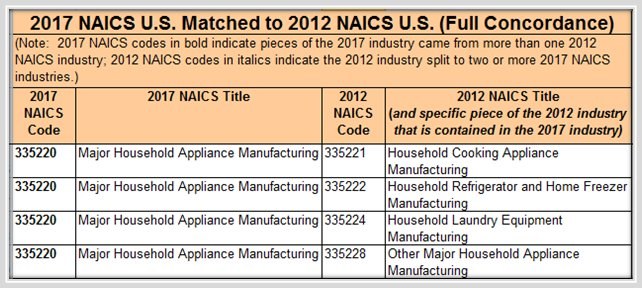

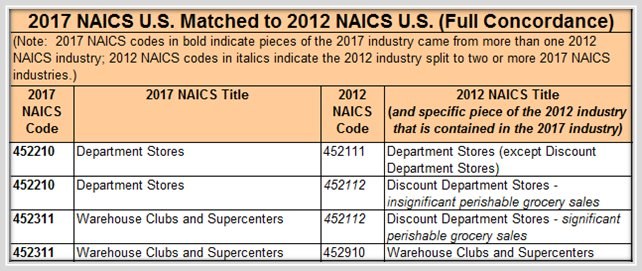

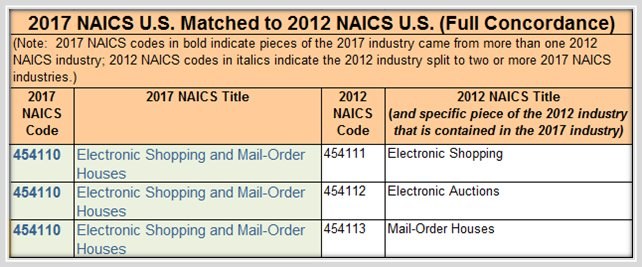

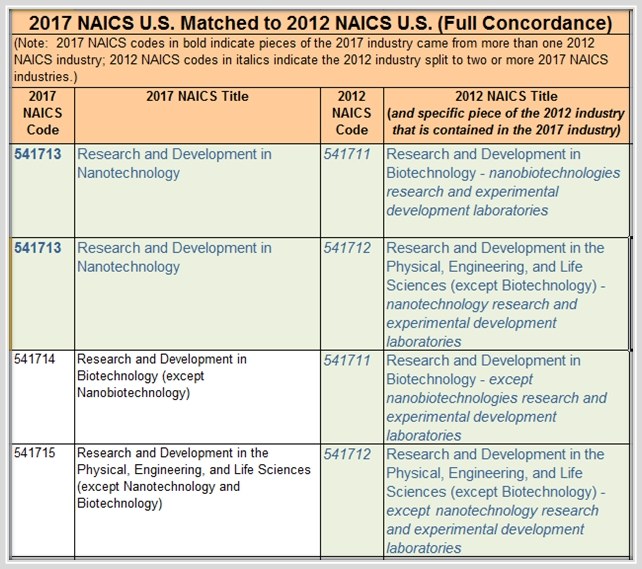

2017 NAICS U.S. Matched to 2012 NAICS U.S. (Full Concordance)

Highlights of NAICS Changes Include:

Crude Petroleum and Natural Gas Extraction (2012 NAICS Code 211111) will be broken into two new codes in 2017. These codes will be 211120, Crude Petroleum Extraction and 211130, Natural Gas Extraction.

Also, Natural Gas Liquid Extraction, (2012 NAICS Code 211112) will become NAICS Code 211130 in 2017.

The 2012 NAICS Code for Lead Ore and Zinc Ore Mining (2012 NAICS Code 212231) is expanding to cover Nickel Ore and Lead Ore Mining (2012 NAICS Code 212234) in one inclusive 2017 NAICS Code: 212230.

The NAICS Codes for Pump and Pumping Equipment Manufacturing (2012 NAICS Code 333911) and the Code for Measuring and Dispensing Pump Manufacturing (2012 NAICS Code 333913) will be combined in 2017 to become NAICS Code 333914, “Measuring, Dispensing and Other Pumping Equipment Manufacturing”.

The 2012 NAICS Codes 335221, 335222, 335224 and 335228 for Household Cooking Appliance, Household Refrigerator and Home Freezer, Household Laundry Equipment and Other Major Household Appliance Manufacturing are all being combined in 2017 to the single NAICS Code: 335220, “Major Household Appliance Manufacturing”.

The 2012 NAICS Code 452112 is being split into two NAICS Code Classifications. The first category under 452112, Discount Department Stores (insignificant perishable grocery sales) is becoming part of NAICS code 452210, “Department Stores”, along with 2012 NAICS Code 452111 for Department Stores (except Discount Department Stores). The Second Category under 452112, (for significant perishable grocery sales) is becoming NAICS Code 452311 “Warehouse Clubs and Supercenters”, along with 2012 NAICS Code for that same category, NAICS Code 452910.

2012 NAICS Codes 454111, 454112 and 454113 for Electronic Shopping, Electronic Auctions and Mail-Order Houses are to be classified under 2017 NAICS Code 454110.

The 2012 NAICS Code 541711 will no longer encompass “Research and Development in Biotechnology (except Nanobiotechnology)”. Also, the 2012 NAICS Code 541712 will no longer encompass “Research and Development in the Physical, Engineering, and Life Sciences (except Nanotechnology and Biotechnology)”. Instead, these will each be classified under the 2017 NAICS Code 541715, “Research and Development in the Physical, Engineering, and Life Sciences (except Nanotechnology and Biotechnology)”

NAICS CODE CHANGES WHERE THE INDUSTRY TITLE AND DESCRIPTION ARE UNCHANGED:

| 2017 NAICS Codes |

2017 NAICS Descriptions | 2012 NAICS Codes |

2012 NAICS Descriptions |

| 452319 | All Other General Merchandise Stores | 452990 | All Other General Merchandise Stores |

| 517311 | Wired Telecommunications Carriers | 517110 | Wired Telecommunications Carriers |

| 517312 | Wireless Telecommunications Carriers (except Satellite) | 517210 | Wireless Telecommunications Carriers (except Satellite) |

| 532281 | Formal Wear and Costume Rental | 532220 | Formal Wear and Costume Rental |

| 532282 | Video Tape and Disc Rental | 532230 | Video Tape and Disc Rental |

| 532283 | Home Health Equipment Rental | 532291 | Home Health Equipment Rental |

| 532284 | Recreational Goods Rental | 532292 | Recreational Goods Rental |

| 532289 | All Other Consumer Goods Rental | 532299 | All Other Consumer Goods Rental |

A new North American Product Classification System (NAPCS) is under development, starting in nine service sectors. Whereas NAICS focuses on the input and production processes of industries, NAPCS will classify all the output of the industries of NAICS.

The long-term objective of NAPCS is to develop a market-oriented, or demand-based, classification system for products that (a) is not industry-of-origin based but can be linked to the NAICS industry structure, (b) is consistent across the three NAICS countries, and (c) promotes improvements in the identification and classification of service products across international classification systems, such as the Central Product Classification System of the United Nations.

Industries in the United States are identified by a six-digit code. Each manufacturing and mining product or service is identified by a ten-digit product code. The product coding structure represents an extension, by the U.S. Bureau of the Census, of the six-digit industry classification of the manufacturing and mining sectors. The product classification system operates so that the industrial coverage is progressively narrower with the successive addition of digits.

An establishment is generally a business or industrial unit at a single, physical location that produces or distributes goods or performs services (e.g., store, factory, farm, etc.).

An enterprise, on the other hand, may consist of more than one location performing the same or different types of economic activities. Each establishment of that enterprise is assigned a NAICS code based on its own primary activity.

An industry classification system facilitates the collection, tabulation, presentation, and analysis of data relating to establishments and ensures that data about the U.S. economy published by U.S. statistical agencies are uniform and comparable. NAICS ensures that such data are uniform and comparable among Canada, Mexico, and the United States. [SOURCE: US NAICS MANUAL]

The North American Industry Classification System (NAICS, pronounced Nakes) was developed as the standard for use by Federal statistical agencies in classifying business establishments for the collection, analysis, and publication of statistical data related to the business economy of the U.S.

NAICS was developed under the auspices of the Office of Management and Budget (OMB), and adopted in 1997 to replace the old Standard Industrial Classification (SIC) system.

It was also developed in cooperation with the statistical agencies of Canada and Mexico to establish a 3-country standard that allows for a high level of comparability in business statistics among the three countries.

NAICS is the first economic classification system to be constructed based on a single economic concept. Click here to learn more about the background, the development and the difference between NAICS and the SIC.

An industry classification system facilitates the collection, tabulation, presentation, and analysis of data relating to establishments and ensures that data about the U.S. economy published by U.S. statistical agencies are uniform and comparable. NAICS ensures that such data are uniform and comparable among Canada, Mexico, and the United States. [SOURCE: US NAICS MANUAL]

The Small Business Administration (SBA) developed size standards for each NAICS category. To find more information about the SBA size standards, click here.

You may also contact SBA’s Office of Size Standards at 202-205-6618 or via email to [email protected]

NAICS categories do not distinguish between small and large business, or between for-profit and non-profit. The Small Business Administration (SBA) develops size standards for each NAICS category. To find more information about the SBA size standards, or when the SBA will update their size standards to reflect 2022 NAICS revisions, visit the SBA Web site at www.sba.gov/federal-contracting/contracting-guide/size-standards. You may also contact SBA’s Office of Size Standards Answer Desk on 800-827-5722 or via email to [email protected]. [SOURCE: US NAICS MANUAL]

Title 13, U.S. Code, Section 9 (a) prohibits the U.S. Census Bureau from disclosing individual company activities including NAICS and SIC codes. The Census Bureau is bound by Title 13 of the United States Code. These laws not only provide authority for the work the census does, but also provides strong protection for the information collected from individuals and businesses.

Title 13 provides the following protections to individuals and businesses:

Private information is never published. It is against the law to disclose or publish any private information that identifies an individual or business such, including names, addresses (including GPS coordinates), Social Security Numbers, and telephone numbers.

The Census Bureau collects information to produce statistics. Personal information cannot be used against respondents by any government agency or court.

Census Bureau employees are sworn to protect confidentiality. People sworn to uphold Title 13 are legally required to maintain the confidentiality of your data. Every person with access to your data is sworn for life to protect your information and understands that the penalties for violating this law are applicable for a lifetime.

Violating the law is a serious federal crime. Anyone who violates this law will face severe penalties, including a federal prison sentence of up to five years, a fine of up to $250,000, or both.

Title 13, U.S. Code is available to download from the Government Printing Office here [PDF 311KB].

We have several easy to use references available:

The Industry Drill-Down provides a complete list of 6-digit codes along with links to the full descriptions and cross-reference to similar codes.

The NAICS Manual & Downloadable Reference Files can be purchased here.

There is no central government agency with the role of assigning, monitoring, or approving NAICS codes for establishments.

NAICS Codes are self-assigned based on the establishment’s primary activity (the activity that generates the most revenue for the establishment)

Individual establishments are assigned NAICS codes by various agencies for various purposes using a variety of methods. The U.S. Census Bureau has no formal role as an arbitrator of NAICS classification.

The U.S. Census Bureau assigns one NAICS code to each establishment based on its primary activity (the activity that generates the most revenue for the establishment) to collect, tabulate, analyze, and disseminate statistical data describing the economy of the United States.

Generally, the U.S. Census Bureau’s NAICS classification codes are derived from information that the business establishment provided on administrative, survey, or census reports. (e.g. when a company applies for an Employer Identification Number (EIN), information about the type of activity in which that business is engaged is requested in order to assign a NAICS code).

Various other government agencies, trade associations, and regulation boards adopted the NAICS classification system to assign codes to their own lists of establishments for their own programmatic needs. If you question the SIC or NAICS code contained on a form received from an agency other than the U.S. Census Bureau, you should contact that agency directly.

There is no central government agency with the role of assigning, monitoring, or approving NAICS codes for establishments. Different agencies maintain their own lists of business establishments to meet their own programmatic needs. These different agencies use their own methods for assigning NAICS codes to the establishments on their lists. Statistical agencies assign one NAICS code to each establishment based on its primary activity. For example, the Social Security Administration assigns a NAICS code to new businesses based on information provided on their application for an Employer Identification Number. The Census Bureau generally assigns NAICS codes to businesses on its list of establishments based on information provided by the business on a survey or census report form. The Bureau of Labor Statistics initially assigns NAICS codes based on business activity information provided on an application for unemployment insurance. [SOURCE: US NAICS MANUAL]

NAICS is a two-through-six-digit hierarchical classification code system, offering five levels of detail. Each digit in the code is part of a series of progressively narrower categories, and the more digits in the code signify greater classification detail. The first two digits designate the economic sector, the third digit designates the subsector, the fourth digit designates the industry group, the fifth digit designates the NAICS industry, and the sixth digit designates the national industry.

A complete and valid NAICS code contains six digits.

In developing NAICS, the United States, Canada, and Mexico agreed that the 5-digit codes would represent the level at which the system is comparable among the three countries. The sixth digit allows for each of the countries to have additional detail (i.e., subdivisions of a 5-digit category). In cases where the U.S. did not choose to create additional detail, the 5- and 6-digit categories within U.S. NAICS are the same, and the 6-digit US NAICS code ends in zero. In some hierarchical presentations, the 6-digit code is omitted where it is the same as the 5-digit category.

Data on international trade in goods are necessarily collected on a commodity basis, whereas NAICS and SIC, data are on an establishment basis.

Commodity groups approximating the NAICS categories were developed, however, and published for the years 1997 through 1999. (These overlap with series for groups using SIC commodity group classifications in the year 1997.)

It should be noted that some of the kinds of distinctions made in NAICS and other industry classifications cannot be made in commodity trade data. A notable example is printing and publishing.

NAICS places publishing in the new Information industry and retains only printing in manufacturing. In commodity trade data, however, the entire value of imported and exported publications is included in the goods classification “Printing, publishing and similar products.”

For additional information, please visit the USITC website.

Do You Have an Additional Question?

The Standard Industrial Classification (SIC) was originally developed in the 1930’s to classify establishments by the type of activity in which they are primarily engaged and to promote the comparability of establishment data describing various facets of the U.S. economy.

The SIC covers the entire field of economic activities by defining industries in accordance with the composition and structure of the economy. Over the years, it was revised periodically to reflect the economy’s changing industry composition and organization. The Office of Management and Budget (OMB) last updated the SIC in 1987.

Before long, the rapid changes in both the U.S. and world economies brought the SIC under increasing criticism. The 1991 International Conference on the Classification of Economic Activities provided a forum for exploring the issues and for considering new approaches to classifying economic activity. In July 1992, the OMB established the Economic Classification Policy Committee chaired by the Bureau of Economic Analysis, U.S. Department of Commerce, with representatives from the Bureau of the Census, U.S. Department of Commerce, and the Bureau of Labor Statistics, U.S. Department of Labor. The OMB charged the ECPC with conducting a “fresh slate” examination of economic classifications for statistical purposes and determining the desirability of developing a new industry classification system for the United States based on a single economic concept. A March 31, 1993, Federal Register notice (pp. 16990-17004) announced OMB’s intention to revise the SIC for 1997, the establishment of the Economic Classification Policy Committee, and the process for revising the SIC.

The provided High Risk/Cash Intensive Businesses by NAICS do not constitute an officially sanctioned list. This list has been compiled through cooperative association with various professionals in the banking industry as a working guideline only. We suggest that your compliance efforts be guided by a lawyer or other specialized professionals. We do not guarantee the accuracy of this list.

Find the SBA Size Standard for any given NAICS code based on Total Employees and/or Annual Sales for any given NAICS Code.